When companies talk about "regulatory change management," they mean the plan they have for keeping up with new laws. It's their system for spotting new rules, understanding how those rules affect their business, and making the right changes to follow them.

Done right, this system keeps a company out of legal trouble and, more importantly, protects you, the customer.

Why This Corporate Stuff Matters to You

Imagine driving on a highway where the speed limit, road signs, and even which side of the road you drive on could change at any moment, without warning. It would be chaos. For a business, the modern world can feel a lot like that, with a constant stream of new rules and laws popping up.

This is where regulatory change management comes in. It's not just a fancy term for a boardroom meeting; it's the GPS a company needs for this constantly shifting legal highway. Think of it as the system that keeps a business safe, legal, and running smoothly.

More Than Just Following Rules

When a company fails to keep up, the consequences go far beyond fines—they can affect you directly. A good plan for managing new rules makes sure that:

- Your data stays safe. New privacy laws pop up all the time, telling companies exactly how they're allowed to handle your personal information. Good management means they actually follow those rules to protect you. You can learn more about these rules and how to protect your privacy by using tools like TermsEx.

- The products you use are reliable. Regulations often set the standards for product safety, quality, and environmental impact. A company with a solid process ensures the things you buy actually meet those standards.

- The companies you trust stay in business. Getting hit with huge fines, legal battles, or even being forced to shut down affects everyone—employees lose jobs and customers lose services.

A good plan for handling new rules lets a company adapt quickly, turning what could be a crisis into a manageable task.

Ultimately, this whole process is about being responsible. It's the framework that proves a business is operating fairly in a world where expectations are always changing. It protects employees from unsafe practices, you from faulty products, and your information from being misused.

This isn't just about a company avoiding a penalty. It's about that company earning and keeping your trust. Without a good plan, they're just driving down that highway with their eyes closed, hoping for the best.

How Companies Actually Handle New Rules

At its heart, managing new regulations is about being prepared, not just reacting to problems. Think of it like a scheduled fire drill. A smart building manager doesn't wait for a fire to start before planning escape routes; they practice them so everyone knows what to do. In the same way, a well-run business gets ready for new laws before they even become official.

This turns potential chaos into an orderly, repeatable cycle. Instead of scrambling when a new rule is announced, the company has a clear plan to follow. This structured approach ensures nothing gets missed, protecting both the business and its customers.

The Life of a New Rule

Let's use a simple example to show how this works. Imagine you own a popular local restaurant. One day, the health department introduces a strict new law requiring you to log the temperature of your refrigerators every day to prevent food poisoning. A good plan for handling this new rule would follow a predictable cycle.

This isn't a one-time thing but a continuous loop. As soon as one change is handled, the restaurant's team is already looking out for the next potential update from the health department.

The sheer number of new rules makes this a constant challenge. In a recent survey, 32% of compliance experts said that keeping up with new regulations was their biggest worry. The problem is even more intense in industries like banking, where 36% of leaders say their biggest challenge is just spotting future rule changes on the horizon. You can learn more about what keeps them up at night by reviewing the full survey results on Compliance Week.

The Four Main Steps of Adapting

Every good plan for managing new rules can be broken down into four basic steps. Each step answers a critical question, moving the business from awareness to action and, finally, to proof that they're following the rule.

The goal isn't just to react to a new rule but to absorb it into the company's daily routine smoothly. It's about making following the rules a natural part of doing business.

To make this crystal clear, let's connect these steps back to our restaurant example. The table below shows how a big idea translates into simple, real-world actions.

The Four Steps to Managing New Rules

| Step | What It Means | Simple Example (The Restaurant) |

|---|---|---|

| Spotting the Rule | Finding out about a new or updated rule that will affect the business. | The restaurant manager gets a notice from the health department about the new temperature logging rule. |

| Figuring Out the Impact | Understanding exactly what parts of the business the new rule touches. | The manager figures out how this affects the kitchen staff, buying new refrigerators, and the daily checklists. |

| Making the Change | Taking action to update routines, train staff, and change systems to follow the rule. | The restaurant buys new thermometers, creates a logging sheet, and trains all the cooks on the new procedure. |

| Proving It's Done | Keeping records of the changes and being ready to show regulators you're compliant. | The manager files the temperature logs daily and has them ready for the next surprise health inspection, proving the rule is being followed. |

This systematic approach makes what can feel like an overwhelming task much simpler. By breaking the challenge into these four steps—spotting the rule, understanding its reach, making the changes, and recording the work—a business can handle almost any new regulation that comes its way.

A Practical Guide to the Four Key Steps

Knowing the idea behind regulatory change management is a good start, but seeing how it works in practice provides a clear roadmap. The whole process breaks down into four logical steps that guide a company from finding out about a new rule to taking final action. Each step builds on the last, creating a structured flow that prevents panic and ensures nothing gets missed.

Think of it like putting together furniture from a box. You wouldn't just dump all the pieces on the floor and start screwing things together randomly. You follow the instructions, step-by-step: first, you identify all the parts, then figure out how they connect, build the item, and finally, check your work to make sure it's sturdy.

Step 1: Spotting the Rule — Catching the First Sign of Change

The journey always begins with discovery. In this first step, a company's only goal is to find out a rule is changing. This isn't a passive activity; businesses can't afford to just wait for a letter in the mail. Instead, they need to be actively listening for signals from government agencies.

Smart companies use a mix of methods to stay ahead:

- Automated Alerts: They use special software that scans government websites and news sources for keywords related to their industry. When a new bill is proposed or a rule is updated, they get an instant notification.

- Expert Help: Many businesses pay for services that translate dense legal language into plain English, highlighting the most important takeaways.

- Industry Groups: Being active in trade associations is another huge advantage. These groups often share insights and early warnings about upcoming rule changes long before they become official.

This first step is all about building an early warning system. The sooner a company knows about a potential change, the more time it has to prepare.

Step 2: Figuring Out the Impact — Connecting the Dots

Once a new rule is on the radar, the next big question is: "So what does this actually mean for us?" This is the impact assessment step, where an abstract rule gets connected to real business operations. It's like a doctor diagnosing a patient—they don't just see a symptom; they figure out how it affects the entire body.

A company has to determine exactly which parts of its business will be affected. This means taking a close look at different departments, processes, and even individual job roles.

A single new rule can create a ripple effect across an entire organization. The impact assessment step is about tracing those ripples to their source and understanding the full scope of the change required.

For example, a new data privacy law doesn't just concern the legal team. It also affects:

- The IT Department: They'll need to update software and security.

- The Marketing Team: They have to change how they collect and use customer data.

- Customer Service: They'll need new training on how to handle user data requests.

This step is crucial for figuring out what resources are needed and creating a realistic plan. Without a thorough assessment, a company might fix one problem while completely missing five others.

Step 3: Making the Change — Putting the Plan into Action

This is where the plan becomes reality. The implementation step is the "doing" phase, where the company actually carries out the plan developed during the impact assessment. It's the most visible part of the process and requires careful coordination across different teams.

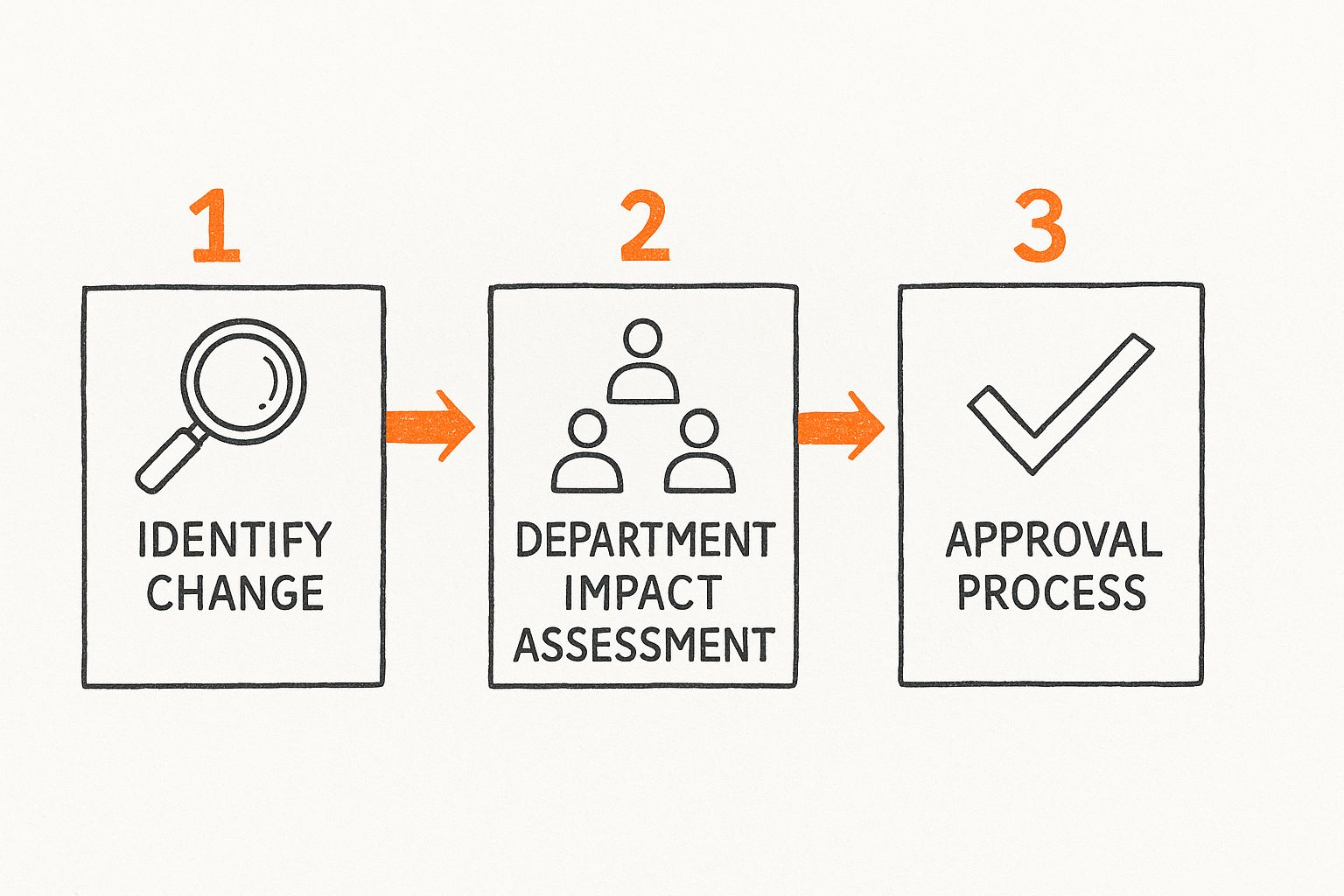

This visual shows a simplified flow for managing this process, moving from spotting a rule to a coordinated review by different departments and final approval.

The image highlights how a new rule must be systematically reviewed by different business units before it can be approved, ensuring a complete and well-thought-out response.

Actions taken during this step often include updating company policies, retraining employees on new procedures, and changing tech systems to meet the new requirements. Clear communication is everything here to ensure everyone understands their new responsibilities.

Step 4: Proving It's Done — The Final Check

The final step is all about accountability. It's not enough to just make the changes; a company must be able to prove it did. This phase involves creating a detailed record of every action taken to follow the new rule. This paperwork serves as hard evidence for regulators, auditors, and even customers that the business is playing by the rules.

This creates a clear paper trail that can be presented during an inspection. In 2025, the need for this careful record-keeping has only grown as regulations have become more complex. Things like new technologies and data protection rules have seriously sped up the pace of change.

KPMG's 2025 Mid-Year Regulatory Report notes that this year has seen historic shifts in rules governing technology, data, and risk management. You can explore more about these trends by reading the full KPMG report on their website.

Ultimately, this four-step process transforms managing new rules from a scary, reactive scramble into a predictable, manageable cycle. By systematically spotting, assessing, implementing, and documenting changes, companies can navigate the shifting legal world with confidence.

New Rules in the Real World

It's one thing to talk about ideas and steps, but it's another to see them in action. These aren't just abstract problems for companies; they're massive shifts that directly impact the products you use and the rights you have every day.

Let's look at two major examples that bring the four-step process to life. These stories show how a structured plan can turn a giant legal headache into a manageable project.

Case Study: GDPR and Your Data Privacy

One of the biggest rule changes in recent memory was the European Union's General Data Protection Regulation (GDPR), which started in 2018. Suddenly, companies worldwide that handled data from people in the EU had to play by a much stricter set of rules.

This is the reason you now see "accept cookies" banners and privacy consent forms on nearly every website. The GDPR gave consumers powerful new rights, like the right to see their data and the right to have it deleted. For businesses, this was a huge change that required a serious plan for regulatory change management.

The GDPR forced companies to completely rethink how they collected, stored, and used personal data, making data privacy a core part of their business instead of an afterthought.

So, how would a typical tech company have handled this using our four steps? Let's walk through it.

- Step 1: Spotting the Rule: Long before the 2018 deadline, smart legal teams saw the GDPR coming. They were monitoring news from the EU and quickly realized this wasn't a minor tweak—it was a complete overhaul of data privacy law that would affect the whole world.

- Step 2: Figuring Out the Impact: Next, the company had to map out every single way it touched customer data. This went far beyond the marketing list. It included website analytics, customer support tickets, payment systems, and even HR records. Every single department had to take a hard look at its processes to see where they fell short of the new standards.

- Step 3: Making the Change: This is where the real work began. IT teams built new systems to handle requests to see or delete data. Marketing rewrote privacy policies to be crystal-clear. Engineers went back into their code to ensure they were collecting only the data they absolutely needed. If you want to see just how complex these processes are, check out what's involved when you request account deletion from our guide.

- Step 4: Proving It's Done: Finally, the company had to document everything to prove it was following the new rules. This meant keeping records of all data it handled, logs of user consent, and detailed procedures for what to do in case of a data breach. This paper trail is essential for showing regulators they took their duties seriously.

Case Study: Environmental Rules and the Shift to Electric Cars

You can see another powerful example in the auto industry. Over the last two decades, governments worldwide have rolled out increasingly tough regulations on vehicle emissions to fight climate change. These rules put incredible pressure on car manufacturers, forcing them to innovate or get left behind.

This constant push for cleaner cars was a primary reason the industry pivoted to hybrid and fully electric vehicles (EVs). It wasn't just a market trend; it was a direct response to a changing legal world.

Spotting and Understanding the Change

First, manufacturers identified the tightening emissions standards years in advance. Their impact assessment made one thing clear: just making gasoline engines a little more efficient wasn't going to be enough. The analysis showed they needed a fundamental change in technology, which pointed straight toward electric cars.

Making the Change and Reporting Progress

The implementation phase meant pouring billions into research and development for battery technology and electric motors. Entire assembly lines had to be redesigned. Thousands of employees needed retraining to build these totally new kinds of vehicles.

Companies then began setting public goals for EV production. This wasn't just for marketing—it was also a way to report their progress toward meeting regulatory deadlines. Today, when you see a car company announce its latest EV model or a new battery factory, you're seeing the final result of a long and incredibly complex process of managing regulatory change.

Modern Tools That Make It Easier to Follow the Rules

Trying to keep track of thousands of regulations by hand is like trying to catch rain in a teacup. It's not just hard; it's practically impossible. As the rules get more complex, companies are turning to technology just to keep up. The right tools can act as a command center, turning a chaotic process into something manageable and proactive.

And the need for that help has never been greater. A recent report found that 85% of compliance professionals say regulatory complexity is still rising in 2025. At the same time, 64% of CEOs see the regulatory environment as a barrier to growth. The challenge is clear: how do you follow the rules without grinding your business to a halt? To solve this, firms are using more automation. You can dig into more of these industry challenges in Compliance & Risks' 2025 report.

GRC Platforms: The Central Hub

The first line of defense is often a Governance, Risk, and Compliance (GRC) platform. Think of it as the central nervous system for a company's compliance efforts. It connects all the different departments—legal, IT, HR, operations—into a single system.

Instead of wrestling with messy spreadsheets and endless email chains, a GRC platform gives everyone a single source of truth. It helps the team:

- Keep Everything in One Place: All policies, procedures, and rules live in one spot, so they're easy to find, update, and review.

- Spot Risks Early: The system can flag potential problems before they become serious issues.

- Make Sure Things Get Done: It automates workflows, sending reminders and assigning tasks to ensure changes actually get made on time.

This centralized approach stops things from falling through the cracks and gives everyone a clear, real-time view of where the company stands.

AI-Powered Tools: The Game Changer

If GRC platforms provide the structure, then artificial intelligence (AI) provides the superpower. AI-powered tools are completely changing the game by automating the most tedious part of regulatory change management: reading and making sense of new legal documents.

Imagine software that can scan a 500-page regulatory update in seconds and instantly point you to the three sentences that actually matter to your business. That's what AI does. It cuts through the noise to find what's important.

AI compliance tools don't just find information faster; they deliver insights that a human might miss, significantly reducing the risk of error.

For instance, a platform like TermsEx uses AI to analyze dense legal documents like privacy policies or terms of service, pulling out the key clauses and risks and summarizing them in plain English.

This screenshot shows how an AI tool can take a wall of legal text and break it down into an understandable summary, flagging potential issues for you.

By applying this same technology to new regulations, companies can drastically cut the time it takes to figure out the impact of a new rule. Teams can instantly see what's new, what's been removed, and how their internal policies need to change. This frees up compliance experts to focus on smart decisions instead of getting buried in paperwork.

Common Mistakes and How to Avoid Them

Even with the best intentions, dealing with new rules is tricky. Mistakes happen. But these aren't just simple slip-ups; they're valuable lessons that show the weak spots in a company's plan.

Understanding these common pitfalls is the first step toward building a stronger process. By seeing where others have stumbled, you can improve your own approach and make sure your response to new rules is smooth and effective.

Let's break down some of the most frequent mistakes and, more importantly, how to sidestep them.

The 'Wait and See' Trap

It's tempting to put things off. You hear rumors of a new regulation, but instead of taking action, you decide to "wait and see" how it plays out. This is like noticing a small leak in the ceiling and hoping it just stops on its own.

Of course, it never does. Before you know it, the deadline is here, and that tiny drip has turned into a flood. The result is a mad dash to fix things, leading to rushed, poorly planned, and expensive solutions that create chaos.

How to avoid it: The answer is to look ahead. By actively keeping an eye on potential rule changes, you give your team the time to plan, budget, and implement changes thoughtfully. A potential crisis becomes just another managed project.

The Communication Breakdown

This is a classic problem. A new rule comes out, and the legal team is all over it. But if they don't clearly explain what it means for the IT, operations, or marketing departments, that knowledge is useless.

Think of it this way: the legal team knows the recipe for a cake has changed, but they never tell the bakers. The kitchen keeps making the old cake, which now fails to meet the new standard—not because anyone is bad at their job, but because of a simple communication gap.

A breakdown in communication is one of the fastest ways to ruin a compliance effort. A new policy is only as good as the ability of the entire organization to understand and follow it.

This disconnect leads to outdated systems, marketing campaigns that accidentally break new rules, and daily routines that are no longer compliant.

Forgetting the People Factor

You can write the most brilliant policies in the world and update every last system, but if the employees on the front lines aren't trained, it's all for nothing. A new rule is just words on paper if the people meant to follow it don't know how or why.

Effective regulatory change management is, at its core, about people. It requires clear training, ongoing support, and solid communication to make sure everyone understands their role in the new way of doing things. Skipping this step is like buying a sophisticated new coffee machine for the office but never showing anyone how to turn it on.

The Documentation Gap

Finally, one of the most critical—and overlooked—errors is failing to document your compliance journey. You might do everything right: figure out the impact, make the changes, and train the staff. But if there's no record of those actions, it's like acing a test but forgetting to write your name on it.

When regulators come calling, they want to see the proof. A detailed paper trail is non-negotiable. It needs to show what changed, who approved it, and when it happened. This documentation is essential for showing the company takes its responsibilities seriously. Creating clear, accessible records—much like our own Terms of Service—is a cornerstone of transparent and responsible operations.

Frequently Asked Questions

When you're dealing with regulatory change management, a few common questions always seem to pop up. Let's tackle them with some straightforward answers.

How Do Small Businesses Handle Regulatory Changes?

It's a classic David vs. Goliath situation. Small businesses don't have large legal departments, so they have to be resourceful to keep up with new rules.

Most get strategic. They join industry groups that break down complex rules into practical advice. They also lean on user-friendly software and subscribe to newsletters from government agencies to get a heads-up on what's coming. It's a mix of smart tools and community knowledge that helps them stay compliant without breaking the bank.

How Often Do Business Regulations Actually Change?

Far more often than you'd think. The pace really depends on the industry. For high-stakes fields like finance or healthcare, you might see new rules pop up several times a year. For example, the U.S. Securities and Exchange Commission (SEC)—the top financial regulator—introduced 64 new rules between 2021 and 2024 alone.

Other industries might see slower changes, but they can be just as important. The main thing to remember is that the rulebook is never finished. It's constantly being updated, which makes paying attention a core part of business.

Think of regulations as a living document that is always being revised. Proactive monitoring isn't a "nice-to-have"—it's an essential business function for survival and growth.

What Is the Difference Between Compliance and Change Management?

It's easy to mix these two up, but they play very different roles. An easy way to think about it is to compare it to health and fitness.

- Regulatory Compliance is the goal. It's the state of following all the rules—like getting a clean bill of health from your doctor.

- Regulatory Change Management is the plan. It's the ongoing workout routine you follow to get and stay healthy, constantly adjusting as new health advice comes out.

Simply put, compliance is the what, and change management is the how. One is the destination, the other is the strategy you use to get there and stay there.

You shouldn't need a law degree to understand complex rules. TermsEx uses AI to translate dense legal documents into simple summaries, helping you spot risks and unfair terms in seconds. Take control of your agreements by trying our free analysis at https://termsex.com.

Article created using Outrank